Basic Journal In Accounting

The common ledger, on the opposite hand, is extra organized and offers a detailed record of every account. It is much less complicated to trace particular account balances and to arrange financial statements utilizing the general ledger. Nevertheless, it can be more difficult to right errors in the general ledger, and it is most likely not versatile sufficient to record sure types of transactions. Earlier Than recording a transaction within the common journal, you must identify the accounts concerned.

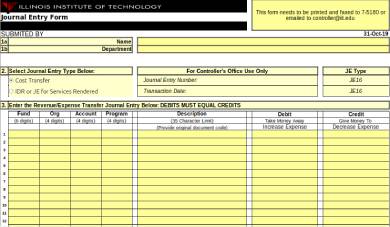

- The normal format ought to embody the date of the transaction, the account being debited, the account being credited, and the amount of the transaction.

- For example, when the corporate spends cash to purchase a model new car, the money account is decreased or credited and the automobile account is elevated or debited.

- Journal Entries can also be personalized based mostly on individual system records.

- An actual journal for a enterprise would possibly eat tons of or hundreds of pages to document its many transactions.

- A common journal is an important a part of the accounting process and helps businesses keep a detailed document of their monetary transactions.

- Bills are increased in debit, so we need to debit the quantity once we record it within the journal.

Account Reconciliation

Even if you’re using an accounting software software, it’s helpful to understand what each journal entry is used for. An simpler approach to handle journal entries is to use automated accounting software, which prepares nearly all of journal entries for your small business routinely. All journal entries require you to use double-entry accounting since they require both a debit amount and a credit amount to be in balance. A journal entry generally known as a general journal is a document of a financial transaction that affects your business. Fairness is on the proper side of the accounting equation which signifies that an increase to fairness is shown by a credit score entry and a decease is shown by a debit entry. Wages at all times lower equity, so wage expense, actually, each expense account, is always debited and always has a debit stability.

When it comes to double-entry accounting, the general journal is on the heart of the process. It is where all financial transactions are recorded in chronological order. Every entry within the basic journal must have no less than one debit and one credit. Understanding debits and credit is crucial to appropriately recording transactions in the general journal. A general journal information the raw entry of monetary transactions in a chronological order.

Common Journal Entries Examples: Bringing All Of It Collectively

Overall, the combination of expertise has streamlined the financial record-keeping process, lowering handbook labor and enhancing efficiency. The general journal is a e-book of original entries, by which accountants and bookkeepers document uncooked business transactions, in the date order according to which occasions occur. A common journal is the first place where data is recorded, and each page in the merchandise options dividing columns for dates and serial numbers, in addition to debit or credit score data. Basic journals are useful for monitoring things like money at the bank, every day cash receipts, expenses and more.

This will assist you to keep monitor of when transactions occurred and make positive that they’re recorded in the appropriate order. It may even make it easier to identify any errors or discrepancies that may https://www.kelleysbookkeeping.com/ come up. An instance of an accrual adjusting entry would be to record the interest earned on a bank account that has not but been acquired. The entry would come with a debit to curiosity receivable and a credit to curiosity income.

Accounting For Managers

Uncover how finance leaders are cutting shut timelines in half with automated when an entry is made in the general journal, journal workflows.

Transactions Are Entered Within The Journal In Chronological Order

To bring the monetary statements in to compliance with the accounting framework such as GAAP, adjusting entries are made on the end of the accounting period. These entries are sometimes made to document accrued income, accrued expenses, unearned income and prepaid expenses. A journal is a report of transactions listed as they happen that exhibits the precise accounts affected by the transaction. Used in a double-entry accounting system, journal entries require each a debit and a credit to complete each entry. So, whenever you purchase goods, it increases each the stock as properly as the accounts payable accounts. When recording gross sales, you’ll make journal entries using cash, accounts receivable, revenue from gross sales, price of products bought, stock, and gross sales tax payable accounts.